Bitcoin and Ethereum continue to rise, but the upward movement is quite uncertain. The longer Bitcoin remains below $100,000, the greater the chances that bearish sentiment will emerge, potentially bringing the price down to the $90,000 range, which could be painful for many speculators.

Today, during Asian trading hours, Bitcoin climbed above $98,000 after Eric Trump, the son of former US President Donald Trump, encouraged the family-backed cryptocurrency platform to invest in Bitcoin. According to him, now is a great time to enter the BTC market. Donald Trump has also made similar calls in the past, and it seems his son is following in his footsteps.

Eric Trump noted that Bitcoin's growth could present a unique opportunity for investors seeking an alternative to traditional financial instruments. He assures that the long-term prospects for cryptocurrency remain positive, given the growing interest in such assets from both private individuals and large institutional investors. "Today's surge is a sign that consumption and confidence in cryptocurrencies are only strengthening," said Trump's son.

It is worth mentioning that the influence of the Trump family on the digital asset market is becoming increasingly noticeable. Numerous statements in support of Bitcoin and other cryptocurrencies attract media attention, contributing to the growing popularity of crypto among a wider audience. In this way, the Trump family strengthens its position not only in politics but also in finance.

Earlier this week, David Sacks, head of artificial intelligence and cryptocurrency at the Trump administration, stated that the administration is still evaluating the possibility of creating a strategic Bitcoin reserve. This disappointed crypto investors who had been expecting swift action on the matter.

Against this backdrop, the crypto market's Fear and Greed Index dropped to 49, indicating a neutral level. This also suggests that market participants are in a state of uncertainty, oscillating between fear and greed. Over the past month, the index has fluctuated, but it is now at low levels, which may indicate upcoming changes in investor sentiment. In such conditions, it is important to pay attention to two key factors: trading volume trends and news related to major players and technological developments. External factors, such as economic forecasts and regulatory changes in the cryptocurrency sector, could also significantly impact the market's current state.

While the index remains at a neutral level, caution is advised, and traders should closely monitor market news.

As for my intraday strategy, I will continue to rely on any significant pullbacks in Bitcoin and Ethereum, expecting the bullish trend to persist in the medium term.

For short-term trading, my strategy and conditions are detailed below.

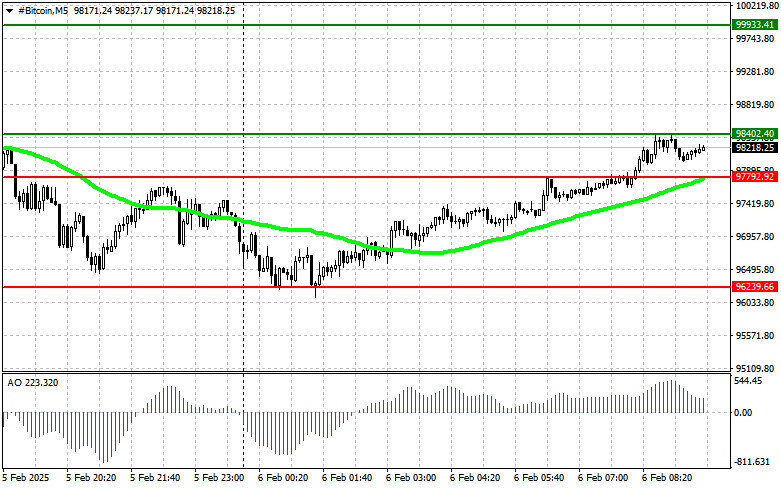

Bitcoin

Buy Scenario

Scenario #1: I plan to buy Bitcoin today if the price reaches $98,400, targeting $100,000. Around $100,000, I will exit long positions and sell immediately on a pullback. Before buying on a breakout, I must ensure that the 50-day moving average is below the current price and that the Awesome Oscillator is in the positive zone.

Scenario #2: Buying Bitcoin is also possible from the lower boundary of $97,700, provided there is no market reaction to a breakout in the opposite direction. The targets are $98,400 and $100,000.

Sell Scenario

Scenario #1: I plan to sell Bitcoin today if the price reaches $97,700, targeting $96,200. Around $96,200, I will exit short positions and buy immediately on a pullback. Before selling on a breakout, I must confirm that the 50-day moving average is above the current price and the Awesome Oscillator is in the negative zone.

Scenario #2: Selling Bitcoin is also possible from the upper boundary of $98,400, provided there is no market reaction to a breakout in the opposite direction. Targets are $97,700 and $96,200.

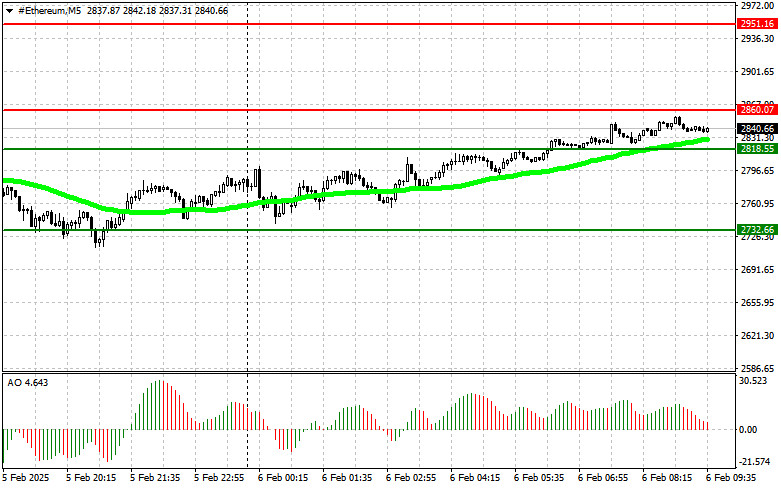

Ethereum

Buy Scenario

Scenario #1: I plan to buy Ethereum today if the price reaches $2,860, targeting $2,950. Around $2,950, I will exit long positions and sell immediately on a pullback. Before buying on a breakout, I must ensure that the 50-day moving average is below the current price and that the Awesome Oscillator is in the positive zone.

Scenario #2: Buying Ethereum is also possible from the lower boundary of $2,818, provided there is no market reaction to a breakout in the opposite direction. Targets are $2,860 and $2,950.

Sell Scenario

Scenario #1: I plan to sell Ethereum today if the price reaches $2,818, targeting $2,732. Around $2,732, I will exit short positions and buy immediately on a pullback. Before selling on a breakout, I must confirm that the 50-day moving average is above the current price and the Awesome Oscillator is in the negative zone.

Scenario #2: Selling Ethereum is also possible from the upper boundary of $2,860, provided there is no market reaction to a breakout in the opposite direction, with targets at $2,818 and $2,732.