Analysis of Trades and Trading Tips for the British Pound

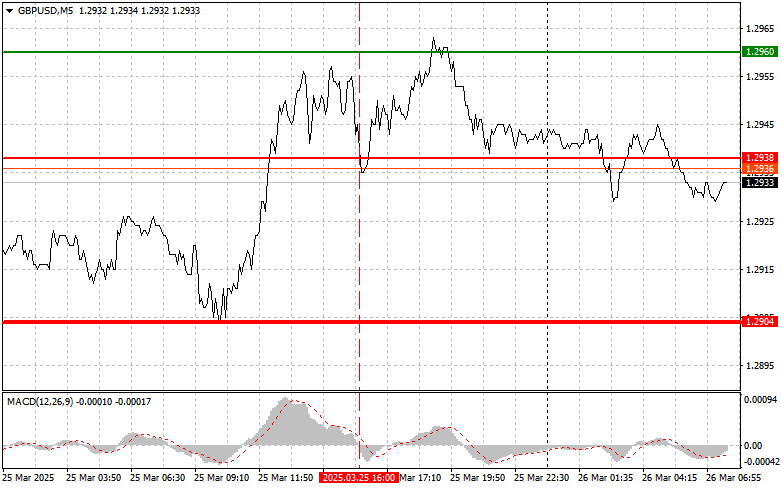

The test of the 1.2938 level coincided with the MACD indicator just starting to move downward from the zero line, confirming a valid entry point for selling the pound. However, as you can see on the chart, the pair never actually moved downward, resulting in a loss.

Unlike many other currencies, the British pound managed to stay afloat and showed resilience to negative factors linked to global economic uncertainty. Weak U.S. data also strengthened the pair, unlike other risk assets. However, it's worth noting that the Bank of England's restrictive policy, which supports the pound, has a downside. High interest rates pressure economic growth by raising borrowing costs for businesses and consumers. This could slow economic activity and even lead to a recession.

Today, we expect genuinely important data related to inflation in the UK. The Consumer Price Index (CPI) and the core inflation reading for February will determine the direction of GBP/USD. The impact of these figures on the pound and the broader economic picture cannot be overstated. As measured by the CPI, inflation directly affects consumer purchasing power and the BoE's interest rate decisions. A higher index could prompt tighter monetary policy, thereby strengthening the pound. The Producer Price Index (PPI) will show how much business input costs have risen. Although less popular than the CPI, the Retail Price Index (RPI) is still used for indexing some contracts and wages. Its trend is also important for understanding the broader inflation picture.

The day will end with the release of the UK's annual budget, which will reveal government plans for spending, taxation, and borrowing. A sharp reduction in spending is expected, which may result in a significant drop in the pound, as it would negatively impact the pace of UK economic growth.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Signal

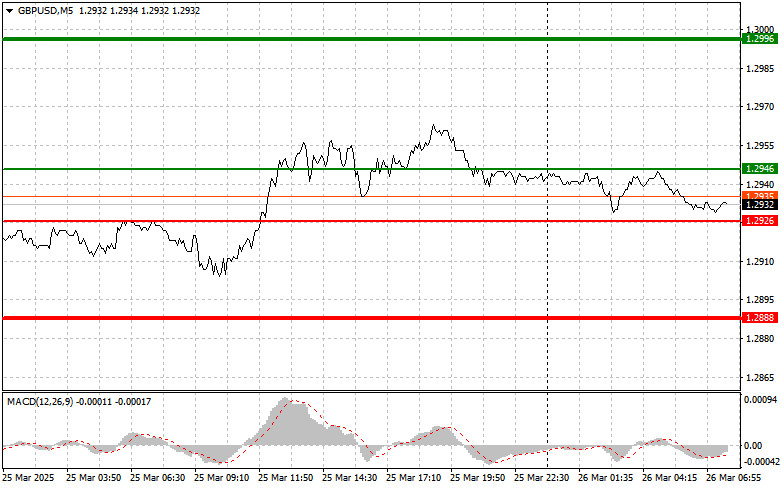

Scenario #1: I plan to buy the pound today at the entry point around 1.2946 (green line on the chart) with a target of 1.2996 (thicker green line). Around 1.2996, I plan to exit long positions and open short positions in the opposite direction, aiming for a 30–35 pip pullback. Buying the pound makes sense only after strong data. Important: Before buying, ensure the MACD indicator is above the zero line and beginning to rise.

Scenario #2: I also plan to buy the pound today if there are two consecutive tests of the 1.2926 level while the MACD is in the oversold zone. This would limit the downside potential and trigger a reversal to the upside. A rise toward 1.2946 and 1.2996 can be expected.

Sell Signal

Scenario #1: I plan to sell the pound after a break below 1.2926 (red line on the chart), which would likely lead to a quick drop. The key target for sellers will be 1.2888, where I plan to exit short positions and immediately open long positions in the opposite direction (expecting a 20–25 pip bounce). It's best to sell the pound at higher levels. Important: Before selling, ensure the MACD indicator is below the zero line and beginning to fall from it.

Scenario #2: I also plan to sell the pound today in case of two consecutive tests of the 1.2946 level while the MACD is in the overbought zone. This would limit the pair's upward potential and lead to a downward reversal. A decline toward 1.2926 and 1.2888 can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.