Trade analysis and tips for trading the Japanese yen

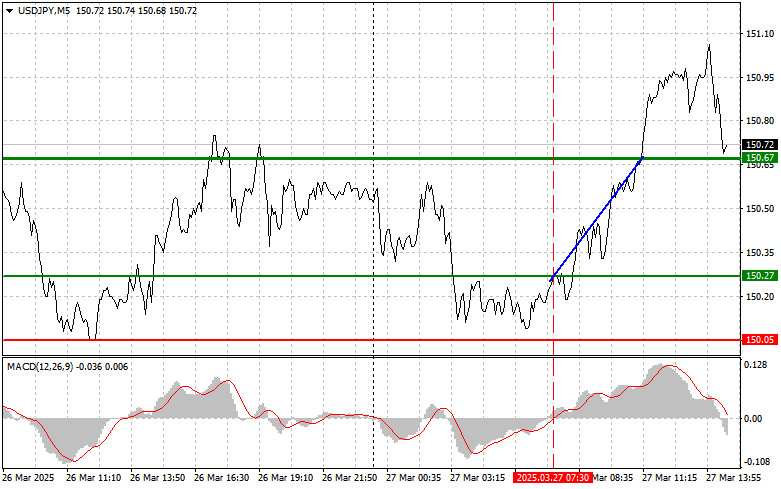

The test of the 150.27 level occurred when the MACD indicator had just begun to rise from the zero mark, confirming a valid entry point for buying the dollar, which led to an upward movement toward the 150.67 target level.

Today, investors will focus on the release of several key macroeconomic indicators from the United States. The spotlight will be on U.S. GDP growth for the fourth quarter of last year, the Core Personal Consumption Expenditures (PCE) Index, and the number of new jobless claims. The GDP report is expected to give an indication of how resilient the U.S. economy is to current challenges such as tariffs and high interest rates. A more significant slowdown in growth would be negative for the dollar.

The PCE Index, one of the main inflation indicators, will also be closely analyzed. Its dynamics will provide insight into the effectiveness of the Federal Reserve's efforts to control inflation.

Attention should also be paid to the U.S. goods trade balance data, which may affect expectations for U.S. economic growth. A trade deficit exceeding forecasts could put pressure on the dollar and prompt a downward revision of economic growth prospects.

In addition to the macro data, markets will closely follow remarks from FOMC member Thomas Barkin. His comments on the current state of the economy and the Fed's monetary policy outlook may have a significant impact on the currency market. In particular, any hints about maintaining interest rates at current levels could boost the dollar and pressure the yen.

As for the intraday strategy, I will rely primarily on the execution of Scenarios #1 and #2.

Buy Signal

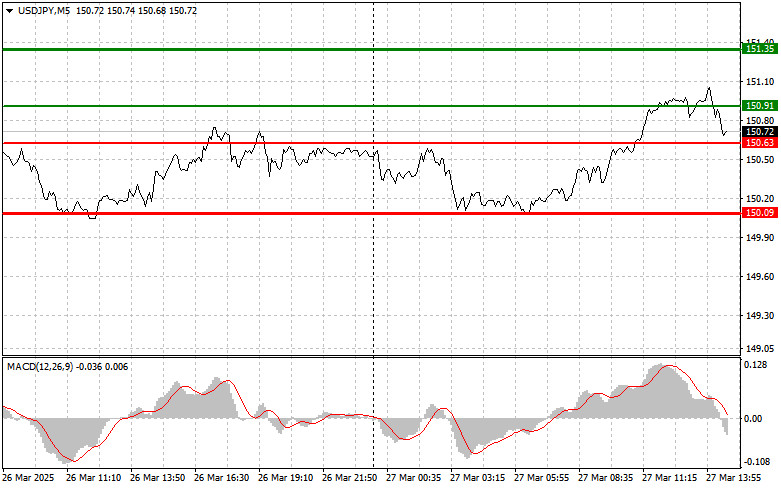

Scenario #1: I plan to buy USD/JPY today at the entry point around 150.91 (green line on the chart), with a target of rising to 151.35 (thicker green line). Near 151.35, I will exit buy positions and open short trades in the opposite direction (expecting a 30–35 point pullback). The pair can be expected to rise within a bullish correction. Important! Before buying, make sure the MACD indicator is above the zero line and just starting to rise from it.

Scenario #2: I also plan to buy USD/JPY if there are two consecutive tests of the 150.63 level, while the MACD is in oversold territory. This would limit the pair's downward potential and trigger an upward reversal. A move to the opposite levels of 150.91 and 151.35 can be expected.

Sell Signal

Scenario #1: I plan to sell USD/JPY today after a breakout below 150.63 (red line on the chart), which would lead to a rapid decline in the pair. The main target for sellers will be 150.09, where I will exit sell positions and open long positions in the opposite direction (expecting a 20–25 point rebound). Downward pressure on the pair is possible at any moment today. Important! Before selling, make sure the MACD indicator is below the zero line and just starting to decline from it.

Scenario #2: I also plan to sell USD/JPY if there are two consecutive tests of the 150.91 level, while the MACD is in overbought territory. This would limit the pair's upward potential and trigger a downward reversal. A move to the opposite levels of 150.63 and 150.09 can be expected.

Chart Notes:

- Thin green line – entry price for buying the trading instrument.

- Thick green line – estimated price to set Take Profit or manually lock in profits, as further growth above this level is unlikely.

- Thin red line – entry price for selling the trading instrument.

- Thick red line – estimated price to set Take Profit or manually lock in profits, as further decline below this level is unlikely.

- MACD Indicator – when entering the market, it's important to follow overbought and oversold zones.

Important: Beginner Forex traders should be very cautious when deciding to enter the market. It is best to stay out of the market before major fundamental reports to avoid sharp price swings. If you choose to trade during news releases, always set stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you're not using money management and trading with large volumes.

And remember, successful trading requires a clear trading plan like the one I presented above. Spontaneous trading decisions based on the current market situation are a losing strategy for any intraday trader.