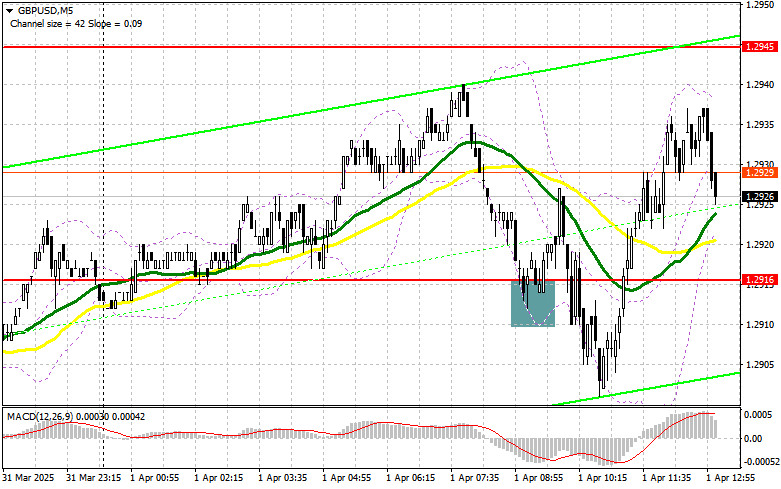

In my morning forecast, I highlighted the level of 1.2916 and planned to make market entry decisions based on it. Let's look at the 5-minute chart and analyze what happened. A decline and the formation of a false breakout at that level led to a buying opportunity for the pound, but after a 10-point rise, demand quickly faded, partially due to the UK data. The technical picture was revised for the second half of the day.

To open long positions on GBP/USD:

The mediocre UK manufacturing PMI, which remained below the 50-point mark, limited the pound's bullish potential in the first half of the day. The U.S. ISM manufacturing index and JOLTS job openings report from the Bureau of Labor Statistics are unlikely to significantly shift the balance of power in the second half of the day. However, if the data comes in much better than expected, it would be wise to bet on dollar strength.

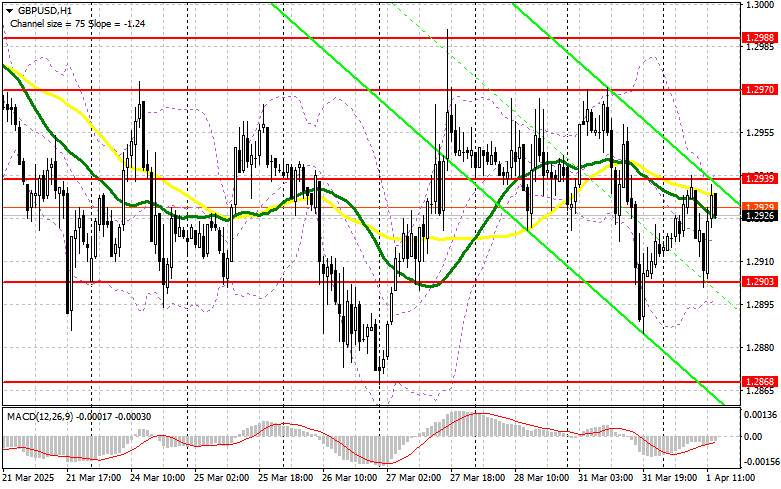

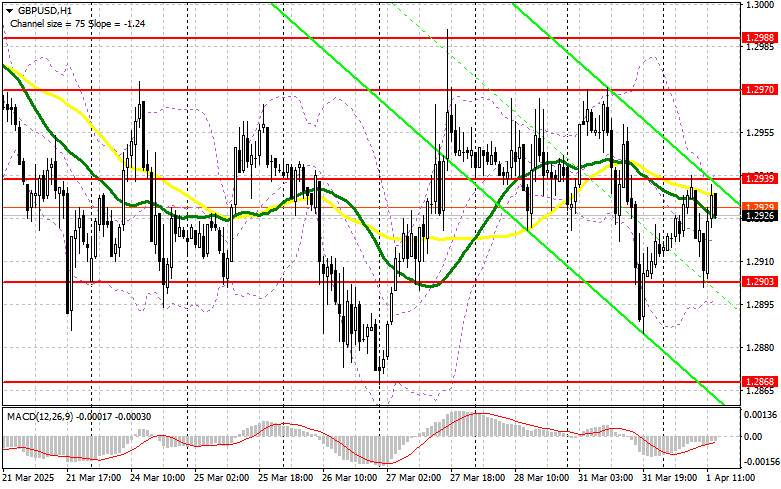

If the pair declines, I prefer to act around the 1.2903 support level. A false breakout there, similar to the earlier example, would provide a good entry point for long positions with a target of restoring the price to the 1.2939 resistance level. A breakout and retest of this range from top to bottom will provide a new entry point for longs, with the goal of testing 1.2970. The final target will be the 1.2988 area, where I plan to take profit.

If GBP/USD declines and there is no buyer activity around 1.2903 in the second half of the day, pressure on the pound will significantly increase. In that case, only a false breakout around 1.2868 would be a valid condition for entering long positions. I plan to buy GBP/USD immediately on a rebound from the 1.2837 support level with a target of a 30–35 point intraday correction.

To open short positions on GBP/USD:

Pound sellers prevented a larger bullish correction in the pair, keeping it within the sideways channel until key U.S. data was released. In case of weak U.S. figures, the pound may rise, but only a false breakout near 1.2939 would provide a short entry signal, aiming for a decline toward the newly formed 1.2903 support. A breakout and retest of this range from below will trigger stop-loss orders and open the way toward 1.2868, negating any attempts by buyers to regain control. The final target will be 1.2837, where I plan to take profit. Testing this level would confirm a return to a bearish market.

If demand for the pound returns in the second half of the day and bears fail to act around 1.2939—where the moving averages are also located and favor the sellers—then it's better to delay short positions until a test of the 1.2970 resistance. I'll open shorts there only after a false breakout. If there's no downward movement from that level either, I'll look for short positions from 1.2988 on a rebound, expecting a 30–35 point correction down.

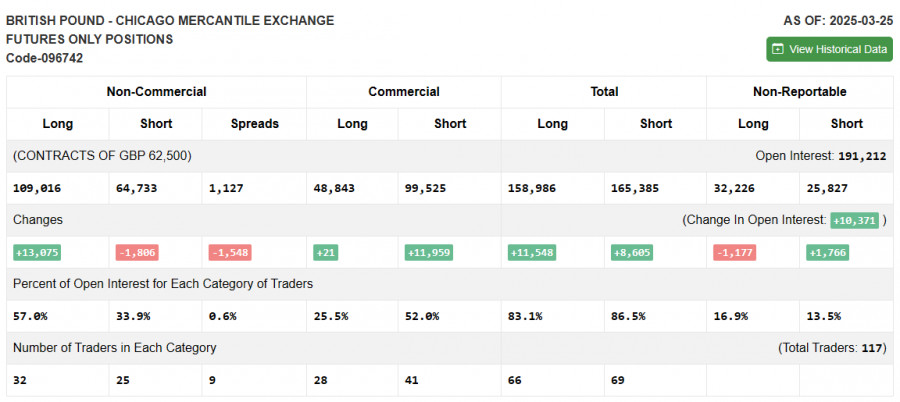

In the Commitments of Traders (COT) report for March 25, there was an increase in long positions and a reduction in shorts. Buying activity on the pound continues, which is visible on the chart. While many risk assets have declined, the GBP/USD pair shows relative stability. Considering the latest inflation data from the UK and comments from Bank of England officials, it is likely that the regulator will leave policy unchanged at the upcoming April meeting, which may temporarily support the pound. However, the impact of U.S. tariffs remains a critical factor. A heightened risk of global economic slowdown will intensify pressure on risk assets, including the pound.

The latest COT report shows long non-commercial positions rose by 13,075 to 109,016, while short positions declined by 1,806 to 64,733. As a result, the gap between long and short positions narrowed by 1,548.

Indicator Signals:

Moving Averages: Trading is occurring around the 30- and 50-day moving averages, indicating market uncertainty.

Note: The periods and prices of the moving averages are considered by the author on the H1 hourly chart and differ from the classic daily moving averages on the D1 chart.

Bollinger Bands: In case of a decline, the lower boundary of the indicator around 1.2895 will serve as support.

Indicator Descriptions:

- Moving Average (MA): Smooths volatility and noise to define the trend. Period – 50 (yellow); Period – 30 (green).

- MACD (Moving Average Convergence/Divergence): Fast EMA – period 12; Slow EMA – period 26; Signal line SMA – period 9.

- Bollinger Bands: Period – 20.

- Non-commercial traders: Speculators like individual traders, hedge funds, and large institutions using the futures market for speculative purposes.

- Long non-commercial positions: The total open long positions held by non-commercial traders.

- Short non-commercial positions: The total open short positions held by non-commercial traders.

- Net non-commercial position: The difference between long and short positions held by non-commercial traders.