Trade Review and Euro Trading Recommendations

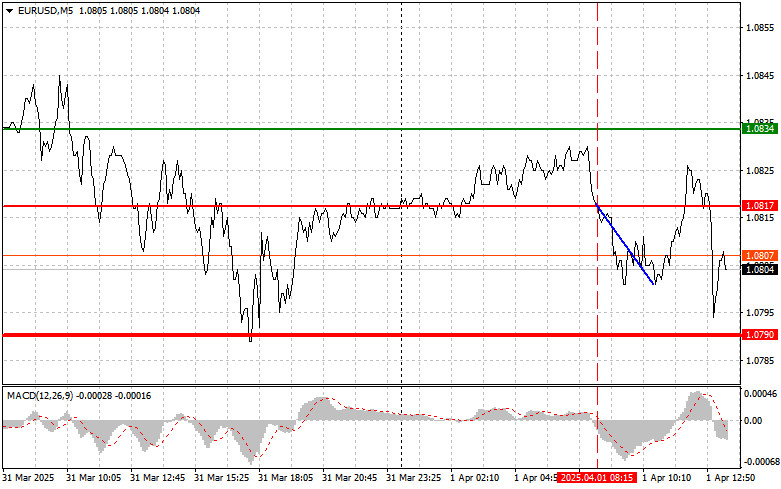

The test of the 1.0817 price level coincided with the MACD indicator just beginning to move downward from the zero line, which confirmed a valid entry point for selling the euro. However, after a 17-point drop, the pressure on the pair subsided.

The anticipated weak PMI data from the Eurozone manufacturing sector failed to exert the expected pressure on the euro. Under current circumstances, this is unlikely to significantly affect the European Central Bank's actions, so traders are in wait-and-see mode ahead of tomorrow's information from Trump regarding tariffs. It's clear that in the short term, the euro will likely remain under pressure due to weak economic data and uncertainty around the ECB's future policy.

Today, the U.S. ISM manufacturing index and JOLTS job openings data from the Bureau of Labor Statistics are due. However, the most interesting event will be the speech by FOMC member Thomas Barkin. Traders are paying close attention to each Federal Reserve official's comments and hints. Given the uncertainty around future interest rate policy, any signals indicating a hawkish stance are seen as cues to support the dollar.

Thomas Barkin, known for favoring tighter monetary policy, could influence market expectations. If he confirms the Fed's willingness to keep rates elevated for longer than expected, it could spark a rise in Treasury yields and, as a result, enhance the dollar's attractiveness to investors. Conversely, if Barkin's tone is softer than expected, the dollar may come under pressure.

As for the intraday strategy, I'll rely more on the execution of scenarios #1 and #2.

Buy Signal

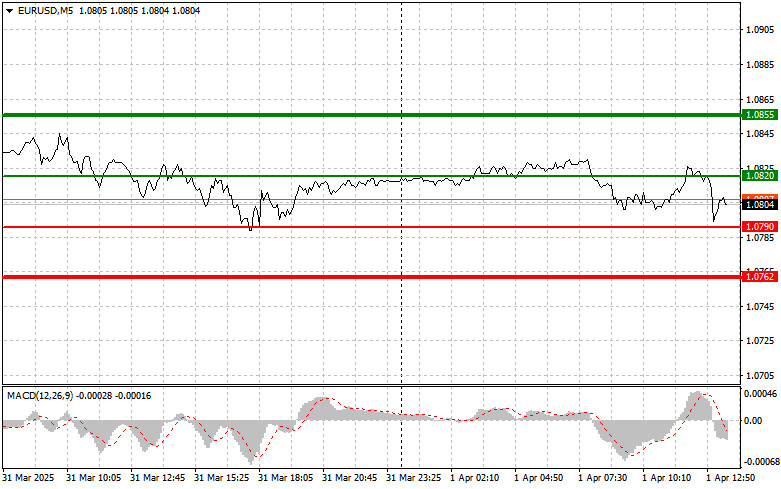

Scenario #1: I plan to buy the euro today upon reaching the 1.0820 entry point (green line on the chart), aiming for growth toward 1.0855. At 1.0855, I plan to exit long positions and sell the euro in the opposite direction, expecting a 30–35 point pullback. Buying the euro today is only justified if U.S. data disappoints and Fed officials strike a dovish tone. Important! Before buying, make sure the MACD indicator is above the zero line and just starting to rise from it.

Scenario #2: I also plan to buy the euro today after two consecutive tests of the 1.0790 level, when the MACD indicator is in oversold territory. This will limit the pair's downward potential and lead to a market reversal upward. A rise toward 1.0820 and 1.0855 is expected.

Sell Signal

Scenario #1: I plan to sell the euro after the price reaches 1.0790 (red line on the chart). The target will be 1.0762, where I intend to exit short positions and buy in the opposite direction, expecting a 20–25 point bounce. Pressure on the pair could return if Fed officials adopt a hawkish tone. Important! Before selling, make sure the MACD indicator is below the zero line and just starting to decline.

Scenario #2: I also plan to sell the euro today after two consecutive tests of the 1.0820 level, when the MACD is in overbought territory. This will limit the pair's upward potential and trigger a downward reversal. A decline to the 1.0790 and 1.0762 levels can be expected.

Chart Reference Guide:

- Thin green line – entry price for buying the trading instrument

- Thick green line – suggested Take Profit or profit-taking area, as further growth is unlikely beyond this point

- Thin red line – entry price for selling the trading instrument

- Thick red line – suggested Take Profit or profit-taking area, as further decline is unlikely beyond this point

- MACD Indicator – When entering the market, it is important to watch for overbought and oversold zones

Important: Beginner Forex traders must be extremely cautious when making market entry decisions. It's best to stay out of the market ahead of major fundamental reports to avoid sudden price swings. If you choose to trade during news releases, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit—especially if you're not applying proper money management and trading with large volumes.

And remember: successful trading requires a clear trading plan, like the one outlined above. Spontaneous trading decisions based on the current market situation are typically a losing strategy for intraday traders.