Markets in turmoil: Wall Street slips amid tariff and recession worries

US stock indexes closed lower on Monday, after a session full of sharp swings. Investors are wary of signs of an economic slowdown and a surge in inflation risks, exacerbated by the White House's aggressive trade rhetoric.

Trump not backing down: Tariffs back in focus

The main trigger for the sell-off was another wave of statements from President Donald Trump about introducing large-scale tariffs. In his evening address on Wednesday, he announced plans to impose tariffs on all imports into the country, and to raise rates even higher for some key partners.

Pressure on China Increases

Not content with the measures already in place, Trump has promised to tighten sanctions against China. He has announced the possibility of additional tariffs of up to 50%, which could more than double the overall level of taxes. This statement has alarmed market participants, forcing many to reconsider their investment strategies.

Volatility is off the charts, volume records

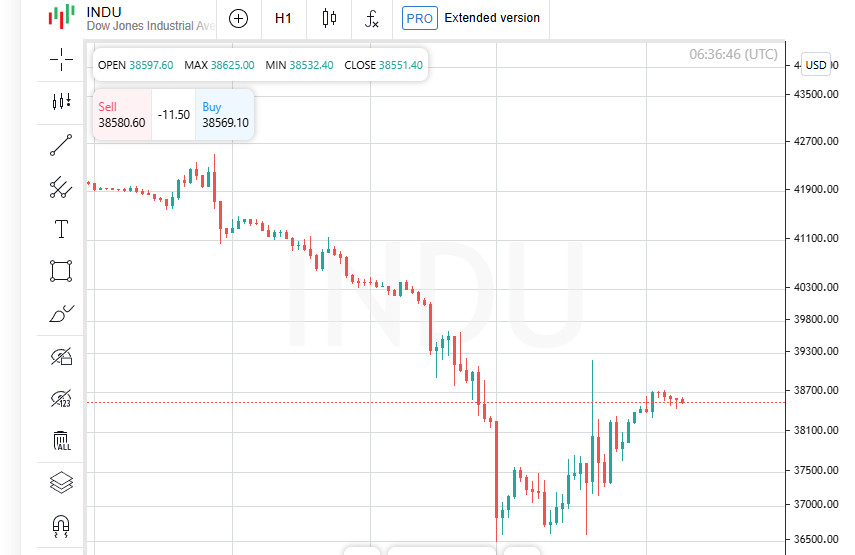

Monday was the second day in a row when US stock exchanges showed abnormally high trading volume. All three key indices - the S&P 500, Dow Jones and Nasdaq - fell sharply in the morning, reaching lows in more than a year. After an unexpected jump upwards, caused by the interpretation of the news about tariffs, the market collapsed again, unable to withstand the pressure.

Fear Gauge Sounds Alarm

The CBOE VIX Volatility Index, often called "Wall Street's fear barometer," broke the psychological 60 mark during the session, its highest since August 2024. Although it eased slightly later, it ended the day at 46.98, its highest close in five years.

Investors Panicked as Dow and S&P Plunge as Market Loses Trillions

Stocks on Monday were a painful day for Wall Street. The Dow Jones Industrial Average fell 349 points to close at 37,965.60, down 0.91%. The broader S&P 500 lost 11.83 points, or -0.23%, to end at 5,062.25. Only the tech-heavy Nasdaq stayed afloat, adding a modest 0.10% to close at 15,603.26.

Biggest Drop Since 2020

The market has continued to suffer losses since the tariff announcement. In the two trading days since Donald Trump's speech, the benchmark S&P 500 has plunged 10.5%, while the combined market capitalization of companies has fallen by about $5 trillion — the worst two-day performance since the pandemic collapse in March 2020.

Dow in Correction, Nasdaq in Bear Mode

The situation on the market has moved into the alarm zone: on Friday, the Dow confirmed the entry into the correction phase, having fallen more than 10% from the record highs of December. The tech-heavy Nasdaq has fallen even further, falling more than 20% from its all-time peak, officially marking the start of a bear market.

Hopes for a respite have failed to materialize

Monday morning trading began with a slump, with the S&P 500 index down 20% from its previous record highs. However, unexpected news of a possible 90-day delay in the introduction of new tariffs triggered a rapid — but brief — rise of more than 3%. Investors feverishly bought up assets, hoping for a easing of the conflict. Those hopes were quickly dashed: the White House officially denied the information, and the market went down again.

Real Estate Sector Plunges Hardest

Real estate took the biggest hit on Monday, with the sector index losing 2.4% on the day, the largest percentage drop among all 11 S&P 500 sectors. Experts attribute the decline to rising market rates and general uncertainty about the outlook for commercial real estate amid economic turmoil.

Communications and Technology: Rare Rays of Light

Amid the general pessimism, only two sectors managed to stay in the green. Communications services led Monday's session, adding 1%, the most among all sectors. Tech also strengthened slightly, showing a 0.3% gain, the second and only positive result after last week's heavy collapse.

Apple and Tesla under pressure, Nvidia and Amazon on top

The mood among large corporations was mixed. Apple continued to fall, losing 3.7%, as investors dumped shares, fearing a drop in demand. Tesla did no better, with its shares falling 2.6%. Meanwhile, Nvidia surprised the markets with a gain of over 3%, continuing a confident upward trend thanks to steady demand for chips. Amazon also pleased holders, adding 2.5% amid positive forecasts for e-commerce.

Europe seeks a foothold

European markets are recovering from a dizzying fall: the regional STOXX 600 index has lost almost 12% in just three days. However, on Tuesday morning, futures signaled a possible rebound, with more than 3% growth. Despite this, investors remain cautious: memories of the sudden collapse caused by Washington's tariff threats are still too fresh.

The US Market Seeks Balance

Monday, while not a happy day, was a bit of a respite. After a rapid 10% drop in two days, a moderately negative close looked almost like relief. But investors continue to watch the events with bated breath.

The Fear Gauge Storms New Highs

One of the main symbols of instability has become the VIX volatility index, nicknamed the "Wall Street fear thermometer." On Monday, it exceeded 60 points - this has happened only twice since the beginning of the COVID-19 pandemic. This level indicates high anxiety among market participants and unstable expectations for the future.

Asian Pivot: Japan Breaks Ahead

While Western markets are digesting the shock, Asian markets are beginning to show signs of stability. Japan stands out in particular, demonstrating noticeable growth and steady interest from investors despite global turbulence. The Land of the Rising Sun seems ready to play the role of a safe haven amid global economic chaos.

Trade Rhetoric or Strategy? Trump's Tariffs Are a Possible Prologue to Negotiations

Amid Washington's tightening trade policy, there are early signs that high-profile tariff threats may be just the start of a more flexible diplomacy. This is evidenced by the fact that US Treasury Secretary Scott Bessent has been appointed to head a delegation that will travel to Tokyo in the coming days to discuss trade agreements. This may mean that the White House is ready for dialogue, despite the aggressive tone of recent statements.

Asia Divided: Japan Wins, Taiwan and the Southeast Fail

Meanwhile, the geographic picture is becoming increasingly contrasting. Japan's TOPIX index soared by 6%, playing off investors' interest in stable economies. Taiwan found itself in sharp contrast: the TWII index fell by 5% due to a shock 32% tariff on semiconductors, the island's key export commodity.

Emerging Asian markets were subjected to particularly harsh tariff pressure. Thailand's SETI plunged to its lowest in five years, while Indonesia's stock market plunged 9% after reopening after a weeklong holiday, while posting a historically weak rupiah. The region's export-dependent economies found themselves in the midst of turbulence.

Gold is back in fashion: a flight to a "safe haven"

Amid growing instability, investors are increasingly turning to gold as a safe haven. Although the precious metal fell to its lowest since March 13 on Monday, it began a steady recovery on Tuesday. Increased demand is explained by fears of an escalation in the global trade war and a desire to preserve capital amid growing uncertainty.

All eyes on the Fed: Markets await signals

Investors are tensely awaiting the publication of the minutes of the US Federal Reserve meeting, which is scheduled to take place on Wednesday. These documents may shed light on the regulator's next steps, especially in terms of its response to foreign policy risks and tariff instability. Bets on gold and other safe havens could rise if the Fed hints at possible policy adjustments in response.

Gold is back on the rise as investors return to safe havens

Amid geopolitical instability and market frenzy, gold has once again become the center of attention. Spot gold was up 0.5% by Tuesday morning (03:40 GMT) to $2,996.60 an ounce. The move higher followed a brief slide on Monday, when prices fell to their lowest since March 13.

All Eyes on the Fed: Markets Await Signals

Investors are anxiously awaiting the release of the Federal Reserve minutes on Wednesday. The documents could shed light on the regulator's next steps, particularly in terms of its response to foreign policy risks and tariff instability. Bets on gold and other safe havens could rise if the Fed hints at possible policy adjustments in response.

Gold Back in Stock: Investors Return to Safe Havens

Amid geopolitical instability and market frenzy, gold has once again become the center of attention. Spot gold prices were up 0.5% by Tuesday morning (03:40 GMT) to $2,996.60 an ounce. The move higher followed a brief slide on Monday, when prices fell to their lowest since March 13.

Futures are growing faster: the psychological threshold has been passed

US gold futures are showing even more confident growth: by Tuesday morning they jumped by 1.3%, breaking the level of $3010.70 per ounce. This indicates that investors are actively hedging risks, factoring into the price possible further shocks in global markets.

All-time high remains in sight

Although gold has retreated from its recent peak, analysts are still closely monitoring the trend. Recall that just a week ago, on April 3, gold set an all-time record, reaching $3167.57 per ounce. The return of interest in precious metals may signal growing anxiety in the financial community.

Other metals: mixed movements

Against the backdrop of gold's rise, other precious metals showed mixed dynamics. Silver showed a slight decline of 0.1%, settling at $30.09 per ounce. Platinum, on the other hand, strengthened by 1.3%, reaching $925.35. Palladium was in the red, losing 0.3% and falling to $915.80.