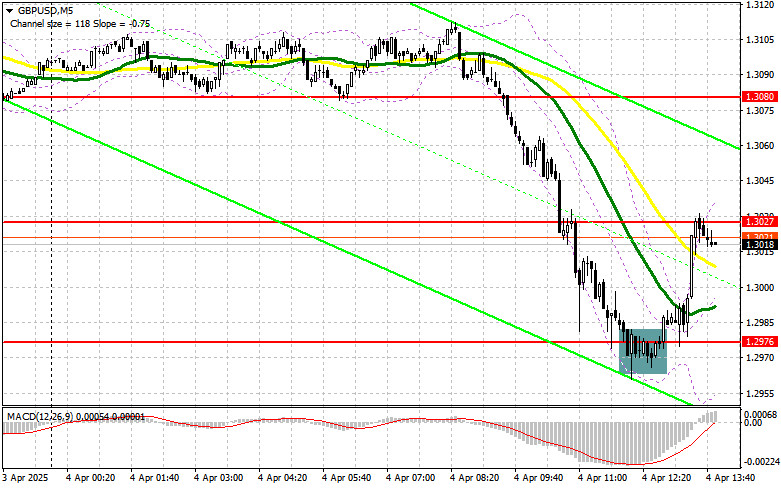

In my morning forecast, I highlighted the level of 1.2976 and planned to base market entry decisions around it. Let's look at the 5-minute chart to see what happened. A decline and the formation of a false breakout at that level provided an entry point for long positions, resulting in a rise of more than 60 points. The technical picture was revised for the second half of the day.

To Open Long Positions on GBP/USD:

The pound experienced a sharp correction following recent comments from Trump, who stated he would negotiate with countries individually. This complicates the negotiation process, which UK representatives had been counting on after the tariffs were introduced. U.S. nonfarm payrolls and the unemployment rate will play a major role this afternoon, and only strong data will lead to another sell-off in the pair. Powell's speech will also be in focus.

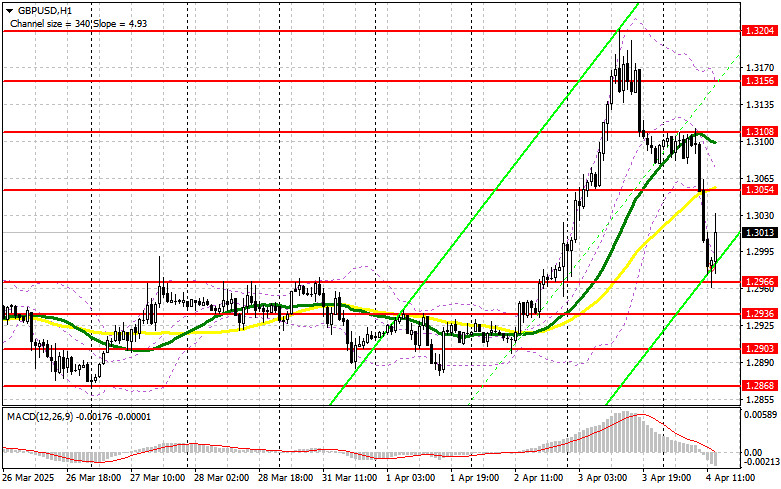

If the pair declines, I prefer to act around the 1.2966 support. A false breakout at that level, similar to the one discussed above, will provide a good entry point for long positions, aiming for a recovery toward 1.3054 resistance. A breakout and retest of this range from above will confirm a new entry point with the prospect of reaching 1.3108. The furthest target will be 1.3156, where I will take profits.

If GBP/USD continues to decline and buyers show no activity near 1.2966, things will go badly for the bulls, and pressure on the pound will increase significantly by the end of the week. In this case, only a false breakout near 1.2936 will be a suitable signal to go long. I also plan to buy on a rebound from 1.2903, targeting a 30–35 point intraday correction.

To Open Short Positions on GBP/USD:

Sellers have made their move and now rely on strong U.S. data to unwind all the gains the pair made after Trump's tariff announcements. If GBP/USD rises further, I won't rush into selling in such a market. Only a false breakout near 1.3054 will provide a sell entry point, targeting the new support at 1.2966, formed today. A breakout and retest of this range from below will trigger stop-losses, clearing the way to 1.2936, which would hurt the bulls. The furthest target will be 1.2903, where I will take profit. A test of this level may return the pair to a sideways range.

If demand for the pound returns this afternoon and bears do not act around 1.3054—where the moving averages are located—selling should be postponed until a test of the 1.3108 resistance. I will only open short positions there after a failed consolidation. If there's no downside reaction even there, I'll look for short entries on a rebound from 1.3156, but only for a 30–35 point correction.

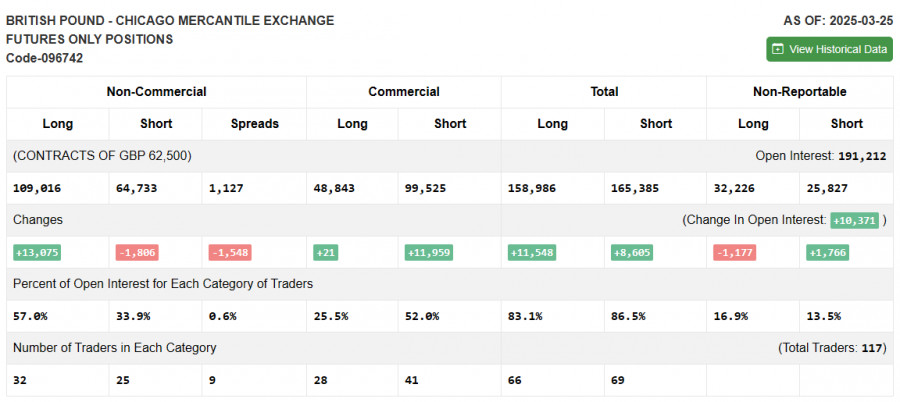

COT Report (Commitments of Traders) – March 25:

The report showed a rise in long positions and a reduction in short positions. Buying of the pound continues, as seen on the chart. While many risk assets have declined, the GBP/USD pair demonstrates stability.

Given the recent UK inflation data and statements from Bank of England officials, the central bank is likely to maintain its current policy stance at the April meeting, which could temporarily support the pound. However, the scale of the impact of U.S. tariffs will be critical. A greater threat of a slowdown in global growth will increase pressure on risk assets, including the pound. Long non-commercial positions increased by 13,075 to 109,016 and short non-commercial positions decreased by 1,806 to 64,733. The gap between long and short positions narrowed by 1,548.

Indicator Signals:

Moving Averages Trading is taking place below the 30- and 50-period moving averages, which signals a downtrend.

Note: The author uses H1 (hourly) chart settings, which may differ from standard daily moving averages on D1 charts.

Bollinger Bands In the event of a decline, the lower band near 1.2980 will serve as support.

Indicator Descriptions:

- Moving Average (MA): Smooths price fluctuations to define trend direction. 50-period (yellow), 30-period (green)

- MACD (Moving Average Convergence/Divergence): Fast EMA – 12, Slow EMA – 26, Signal SMA – 9

- Bollinger Bands: 20-period bands that reflect price volatility

- Non-commercial traders: Speculators such as individual traders, hedge funds, and institutions

- Long non-commercial positions: Total long open positions of non-commercial traders

- Short non-commercial positions: Total short open positions of non-commercial traders

- Net non-commercial position: Difference between long and short positions held by non-commercial traders